Decentralized Finance (DeFi) is a world where adapting and fine-tuning strategies are essential to navigate ever-changing market situations. Coinrule is a platform that specializes in automated trading. It offers a powerful tool for this: customization flexibility. Coinrule allows users to customize, optimize, and adjust their trading strategies according to their goals, risk tolerance, and preferences. This customization feature not only allows traders to create strategies that are aligned with their vision but also improves their ability to respond to market changes. This article will explore how Coinrule’s customization flexibility plays a critical role in improving trading strategies and enabling better decision-making.

Flexible Trading Strategies Are Important

Market conditions constantly change, especially in the fast-paced world of DeFi and crypto. It is important to customize a trading plan to allow users to tailor their strategy to their goals and adapt to market changes. Coinrule, a flexible platform, allows users to define precise conditions for buying and selling, managing risks, and making a profit. This means that they can customize strategies to suit both the current market dynamics and personal trading styles.

Traders are limited by their inability to customize strategies, and thus, have little opportunity for improvement. Coinrule’s flexibility in customization addresses this issue by giving users tools to build and customize every aspect of their strategies.

The Customization Flexibility of Coinrule Enhances Trading Strategy

The Coinrule platform is designed to accommodate a wide range of trading styles and goals, making it suitable both for experienced and novice traders. Coinrule’s customization flexibility allows traders to develop more effective trading strategies.

- Adaptation to Market conditions: Markets rarely remain static. Being able to adapt strategies to current trends and capture opportunities is key to managing risk and capturing potential. Coinrule allows users to modify rules based on market conditions. For example, they can tighten stop-loss levels in volatile markets or adjust buy/sell triggers according to momentum shifts. This flexibility allows traders to fine-tune strategies and become more resistant to price fluctuations.

- Risk Management Customization Effective risk management is at the core of every successful trading strategy. Coinrule allows users to customize their risk management parameters, including stop-loss, take-profit, and reentry conditions. Traders can reduce their exposure to unwanted risks by setting up these conditions. They can also secure profits when certain thresholds have been met. DeFi is a market where volatility is high and risk management is key to long-term success.

- Support for Multi-Assets and Multi-Strategies: Many traders like to diversify their trading portfolios by experimenting with multiple assets. Coinrule’s platform allows users to create and manage several strategies simultaneously across different tokens. A user could, for example, run a long-term accumulation strategy with one asset and a short-term profit-taking strategy with another. This flexibility allows traders to build a portfolio that is more balanced and aligned with their investment goals.

- Rule-Based Precision: Coinrule’s platform allows users to set specific conditions for every aspect of their strategy. This ensures that each action taken by the robot follows a clearly defined rule. Traders can specify when and how they want to buy or sell, based on factors such as price, volume, or percentage changes. This precision helps to reduce the chance of unintentional actions, and it ensures that trading strategies are executed as planned.

- Customizable Notifications and Alerts: Making timely decisions requires staying informed about market activity. Coinrule offers customization options that include alerts and notifications based on rules. Users can, for example, choose to be notified when a certain price level is reached. This allows them to remain informed and make necessary adjustments. This feature is especially useful for traders who want to keep track of market changes without having to constantly monitor the charts.

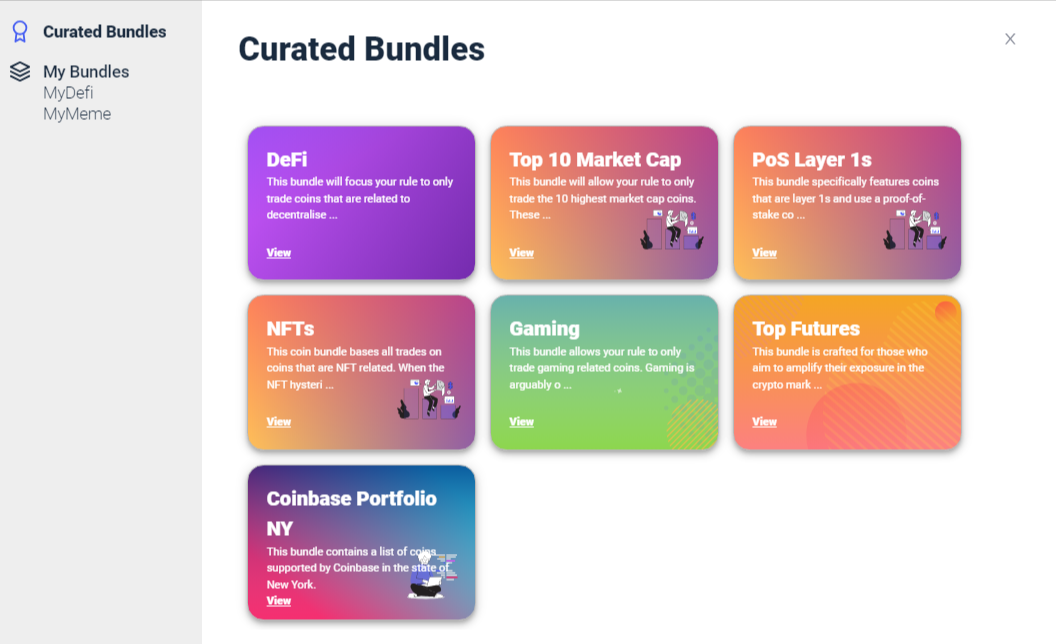

- Coinrule offers pre-built template options for beginners to automate trading. Users are not limited to using the templates in their original form; they can customize and modify each template according to their preferences. Beginners can begin with a “take profit” or “buy the dip template” and adjust the parameters over time as they gain more experience. This allows users to build their confidence and develop their skills while creating strategies that match their goals.

Customization flexibility can benefit traders.

Here are some examples to illustrate how Coinrule can be used by traders to improve their trading strategies.

- Trading rules can be created by experienced traders who are looking for precision. They might only buy when certain price, volume, and trend indicators line up, thus reducing the chance of investing in a weak trend.

- The yield farmer could set up rules to automatically transfer profits from one token to a higher-yield DeFi pool, allowing him or her to maximize returns without having to constantly manage each transaction.

- Long-term investors can design strategies to buy on dips in the market and set high thresholds for stop-loss sales to avoid panic-selling during minor fluctuations. This allows them to focus their attention on long-term gains while minimizing downside risk.

- Portfolio managers can use different strategies for different assets, based on risk and reward conditions that are unique to each asset. This tailored approach allows them to optimize their portfolios rather than relying solely on a single strategy.

Coinrule Customization: Build Confidence and Control

The customization flexibility of Coinrule gives traders a feeling of control and confidence. Knowing that their strategy is customized to meet their needs gives traders peace of mind, allowing them to stay on track even in times of uncertainty. Users can refine their trading strategies as they become more familiarized with the platform. This allows them to create a trading strategy that reflects their evolving market knowledge and their level of experience.

Beginners can progress gradually with the customization flexibility. Beginners can begin with simple templates and then experiment with changing individual parameters before creating fully customized strategies. This learning path helps beginners develop the confidence and skills needed to make more complex trading decisions.

Final Thoughts

Coinrule’s trading automation flexibility is a feature that empowers users to create strategies that align with their goals and market perspective. Coinrule’s detailed control of every aspect of strategy design allows users to adapt to changing market conditions and manage risk efficiently. They can also create a trading style that reflects personal preferences.

Coinrule’s flexible platform is a great tool for both novice and experienced traders. It helps to improve trading strategies, support better decision-making, and encourage a disciplined approach to DeFi Automation. Coinrule’s customizable platform allows traders to be well-equipped for the future as markets continue to change.